I understand that the idea of ‘mindset’ influencing your bank account might initially sound abstract. But let me explain.

This isn’t about wishful thinking; it’s grounded in proven psychological principles.

A wealth mindset shapes how you think about money and success. It’s about switching from a ‘lack’ mentality to an ‘abundance’ mentality.

Research shows that individuals who approach life with a positive and proactive attitude tend to achieve higher levels of success.

So, what does this have to do with wealth?

A lot. A wealth mindset means more than just hoping you’ll succeed hugely.

It involves:

- setting clear goals

- embracing learning

- breaking through self-imposed limits

- looking at setbacks as opportunities for growth

The key components of a wealth mindset include goal-setting, resilience, ongoing learning, and adaptability.

Staying aware of your financial situation and making informed choices is vital.

Keep in mind that adopting a wealth mindset isn’t an overnight transformation.

It requires commitment and consistent application of these principles.

But when they become habitual, the potential to increase your wealth multiplies.

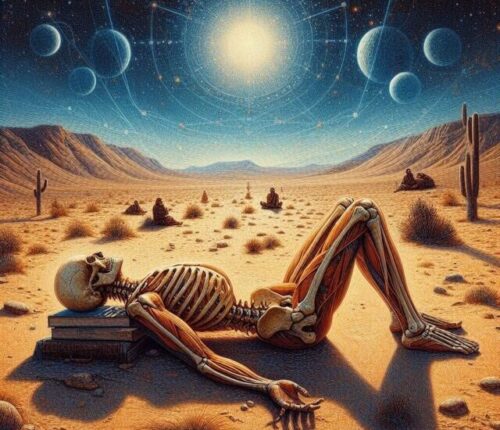

It may surprise you, but there’s also a spiritual dimension to building wealth.

That’s right—the world’s financial gurus aren’t just about balance sheets and investment portfolios.

Next, I’ll guide you through blending traditional methods with spiritual strategies that align your energy to increase abundance.

Get ready to explore:

- the power of affirmations

- the Law of Attraction

- the impact of visualizing success

Spiritual Strategies for Financial Abundance

You may have noticed how some individuals seem to attract wealth easily.

This is no accident.

Beyond budget sheets and investment charts, there’s a world where spirituality intersects with finance.

It’s about aligning inner purpose with outer actions.

In this realm, affirmations, the Law of Attraction, and visualization are not just buzzwords; they’re tools for crafting a reality rich in financial abundance.

Affirmations are powerful.

They’re self-fulfilling prophecies that shape our beliefs and, eventually, our reality.

Begin each day with a clear statement of intent:

‘I am a magnet for financial prosperity’

or

‘My actions create constant wealth.’

Repeat these affirmations with conviction and the emotions they bring with them, and observe how they infuse your daily activities with a prosperity-focused purpose.

Then there’s the Law of Attraction:

This principle suggests that positive or negative thoughts bring positive or negative experiences into a person’s life.

To harness this for wealth, focus your thoughts and energy on what financial success looks like for you.

Imagine checks arriving in the mail, visualize your bank account growing, or picture shaking hands on a successful deal.

Visualization is another potent ally:

It’s not mere daydreaming; practised systematically, it can be a blueprint for success.

Every morning or night, close your eyes and construct a detailed mental image of your desired life.

See yourself in a scenario where you are financially thriving, not just getting by.

The sharper the image, the more tangible it becomes to your subconscious, prompting you to act in ways that align with that vision.

Innovative Investment Avenues in the Modern Market

Today’s investment landscape is a dynamic mix of traditional strategies beefed up with fresh, innovative opportunities.

It’s exhilarating to step into this modern arena, where technology and globalization have unlocked new doorways to wealth.

Cryptocurrency has surged onto the scene,

captivating attention with its promise of ground-breaking returns.

While I approach this field with due caution, recognizing both the high potential for reward and the risks, it’s vital to become literate in blockchain technology and understand the principles behind digital currencies if you’re eyeing this market.

Another avenue gaining traction is crowdfunding,

where small investments can snowball into significant sums.

Whether assisting startups, supporting artistic ventures, or investing in real estate projects, crowdfunding platforms have democratized investment, offering financial and emotional returns.

Peer-to-peer lending, meanwhile,

connects individual borrowers to investors seeking returns beyond traditional banking products.

The appeal here is in the direct impact your money can have, helping others while potentially earning more for your wealth reserves.

Rounding out the innovative investment discussion, there’s the emerging focus on sustainable and ethical investing.

Here, your dollars support companies aligning with your values, from environmental stewardship to social responsibility, without compromising monetary returns.

It’s about building wealth that feels good in more ways than one.

Smart Financial Moves for Long-Term Wealth Accumulation

Building a healthy financial future isn’t just about making money; it’s about making smart choices with the money you have.

Think of it as a chess game where strategic moves now can lead to a victory later.

There are specific strategies that can set you on the path to long-term wealth accumulation.

Firstly, exploring tax-efficient saving and investment strategies is crucial.

The less you pay in taxes, the more of your earnings you can invest back into your wealth-building plan.

Take advantage of tax-deferred retirement accounts like 401(k)s and IRAs, but watch for other tax-saving opportunities.

Diversification is the next step.

It’s simply not putting all your eggs in one basket—spread your investments across various asset classes to mitigate risks.

If one part of your portfolio takes a hit, the other can help keep you afloat. This is financial resilience.

Automating your finances can be beneficial.

Automatic transfers to savings accounts or investments mean you’re consistently building wealth without thinking about it.

It removes the temptation to spend what you could be saving.

Finally, it cannot be overstressed how vital staying informed is.

Financial markets and opportunities are constantly changing, and keeping up-to-date will empower you to make savvy decisions.

Read, research, and even consider financial advice if you need it.

Harnessing the Power of Tech to Grow Your Wealth

As we shift our perspective from traditional wealth-building strategies, it’s impossible to ignore the rapid rise of technology in finance.

Financial technology, or ‘fintech’, is revolutionizing how we interact with money, offering powerful tools to those keen to increase wealth.

Think budgeting apps and online tools.

They’re innovative for individuals serious about tracking and improving their finances.

By giving real-time insights into spending habits, they offer invaluable data that can help streamline budgeting and saving efforts.

Then, there’s the emerging world of robo-advisors.

These digital platforms use algorithms to offer investment advice tailored to your financial situation and goals.

With minimal fees, they’ve become attractive for folks looking to start or diversify their investment portfolios.

But it’s not just about managing money.

Financial technology also includes platforms that allow you to learn about and invest in stocks, bonds, and other securities from your smartphone or laptop.

Stay-at-home parents, students, and professionals can now grow their wealth from anywhere, at any time.

Social media, too, plays an increasingly pivotal role in wealth accumulation.

Platforms like Twitter and Reddit provide unprecedented access to financial wisdom and have shown the capacity to influence market trends and investor behaviour.

However, caution is advised—jumping on bandwagons without due diligence can be risky.

As you explore these tech-driven ways to boost your financial position, remember that wealth isn’t just about accumulation but smart decision-making.

With the right tools, knowledge, and self-discipline, increasing wealth in today’s digital age is more accessible than ever.

Cultivating Wealth through Entrepreneurship and Innovation

I’ve shared insights on leveraging technology and spiritual strategies to amplify your wealth.

Now, I turn to a sphere where creativity meets opportunity: entrepreneurship.

This isn’t just about starting a business; it’s about a mindset that sees the potential for wealth creation in innovative solutions and customer value.

When I examine successful entrepreneurs, a pattern emerges: they spot needs and craft compelling solutions.

It’s about tuning into market trends and customer behaviours and then responding with agility.

Entrepreneurship is a dynamic wealth-building arena where the brave prosper.

If your goal is to grow wealth, think about scalability.

Can your idea grow without continuously demanding more time or resources?

Digital platforms are your friends here.

They offer unprecedented access to markets and the ability to automate and outsource like never before.

Remember, building a business also means creating a brand.

It’s the emotional and psychological relationship you establish with your customers.

In a crowded market, a resonant brand can be your greatest asset.

It’s not just about a logo or a slogan; it’s about the story you tell, the consistency you maintain, and the trust you build.

Final Thoughts

In conclusion, the road to increased wealth is multifaceted.

Each method offers unique advantages, from affirmations to AI, visualization to venture capital.

It’s crucial to align your pursuits with your personal values, strengths, and lifestyle.

Stay informed, stay flexible, and remember that wealth isn’t just about having money—it’s about cultivating a life of abundance in all its forms.

Embrace learning, stay open to change, and use these methods not as ends but as tools to create a prosperous and fulfilling life.

Take a break to Increase your Productivity and Well-being

- Immediate Stress Relief in 40 minutes a day

- Mindful Millionaire

- 5 Mindful Practices for Novice Millionaires: Stage 2

- Mastering Your Mindset: The Power of Thoughts and Feelings

- Millionaire Roadmap Daily Challenge: 6 Steps to Developing the Millionaire Mindset

- Transformation for Novice Millionaires: Unlocking the Psychology of Business Success in 7 stages